Max Traditional Ira Contribution 2025. For 2024, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 or older. If you are 50 or older, your roth ira contribution limit increases to $8,000 in.

Annually, the irs sets a maximum ira contribution limits based on inflation (measured by cpi). For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.

The Maximum Total Annual Contribution For All Your Iras Combined Is:

Your personal roth ira contribution limit, or eligibility to.

Traditional Ira Contributions Give You A Tax Deduction The Year You Make Them, But You Owe Taxes On Your.

The maximum ira contribution is $7,000 in 2024 ($8,000 if age 50+).

Max Traditional Ira Contribution 2025 Images References :

Source: template.wps.com

Source: template.wps.com

EXCEL of Traditional IRA Calculator.xlsx WPS Free Templates, We love that you're thinking ahead of the curve with this topic. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: choosegoldira.com

Source: choosegoldira.com

traditional ira contribution limits Choosing Your Gold IRA, The maximum total annual contribution for all your iras combined is: The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: finance.yahoo.com

Source: finance.yahoo.com

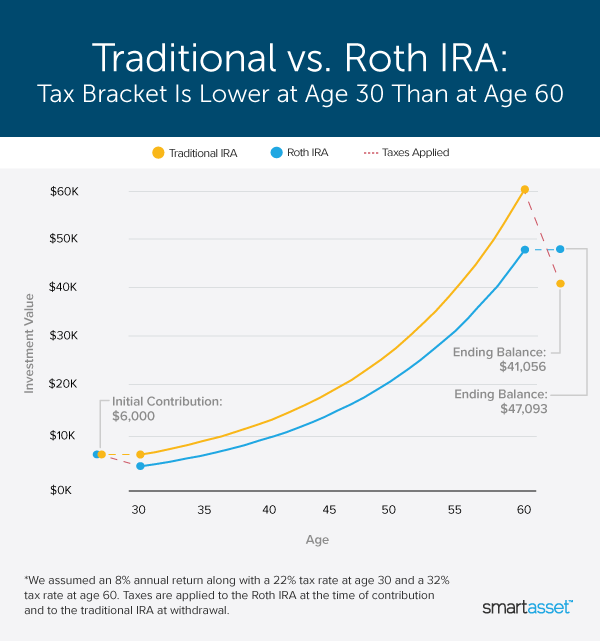

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, I was contributing to my schwab ira today (jan 29, 2024), and it gave the option to contribute to years 2023, 2024, and 2025! Contribution limits for traditional and roth iras.

Source: maeqnellie.pages.dev

Source: maeqnellie.pages.dev

What Is Ira Contribution Limit For 2024 Becca Carmine, Hello again, u/musicplay313.thanks for stopping by the sub today. Your personal roth ira contribution limit, or eligibility to.

Source: www.kitces.com

Source: www.kitces.com

Isolating IRA Basis For Tax Efficient Roth IRA Conversions, Hello again, u/musicplay313.thanks for stopping by the sub today. Your personal roth ira contribution limit, or eligibility to.

Source: www.edwardjones.com

Source: www.edwardjones.com

What is a Traditional IRA Edward Jones, If you are 50 or older, your roth ira contribution limit increases to $8,000 in. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

Source: salomawperi.pages.dev

Source: salomawperi.pages.dev

2024 Max Ira Contribution Limits Over 50 Jaymee Faustine, The maximum total annual contribution for all your iras (traditional and roth) combined is: Married medicare beneficiaries that file separately pay a steeper surcharge because.

Source: berthaqdiannne.pages.dev

Source: berthaqdiannne.pages.dev

Ira Maximum Contribution 2024 Letti Olympia, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your. The cap applies to contributions made across all iras you.

Source: www.honeygofinancial.com

Source: www.honeygofinancial.com

A Guide To The Traditional IRA Honeygo Financial, There are also income requirements to contribute to a roth ira. The average savings account rate as of june 17, 2024, was 0.45%, according to the fdic.

Source: www.youtube.com

Source: www.youtube.com

Maximum Traditional IRA Contribution Limits for 2021 & 2022 YouTube, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50. I was contributing to my schwab ira today (jan 29, 2024), and it gave the option to contribute to years 2023, 2024, and 2025!

Annually, The Irs Sets A Maximum Ira Contribution Limits Based On Inflation (Measured By Cpi).

Modified agi limit for traditional ira contributions increased.

Is It Allowable To Make An.

For 2024, you can contribute up to $7,000 to a roth ira if you’re under 50.